Creating credit notes

On occasion, you may need to create a credit note of refund for a student without using the enrolment cancellation process. This may be because you wish to offer the student a credit to apply to further training (perhaps there was problem with the class they attended), because they purchased another product outside of the class enrolment, or because you created a credit note for the wrong amount during the enrolment cancellation.

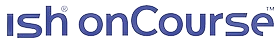

Manually create a credit note

- Begin by opening the Invoice window. In the bottom right-hand corner is a + button. Click it.

- In the new Invoice record window, type the name of the contact you wish to give the credit note/refund to. The contact needs to already exist within onCourse.

- In the invoice lines section of the window, click on the '+' button to add charges/credits to the record. Give your item a title, select the general ledger income account it will be debited from, enter the appropriate negative amount in the 'Price Each Ex Tax' field. Ensure if you are creating a credit note that the value has a minus sign in front of it.

- Enter any other relevant information and save the credit note. You will now see in the list view window an unbalanced invoice for a negative amount. This is the credit note.

Figure 251. Creating a manual credit note

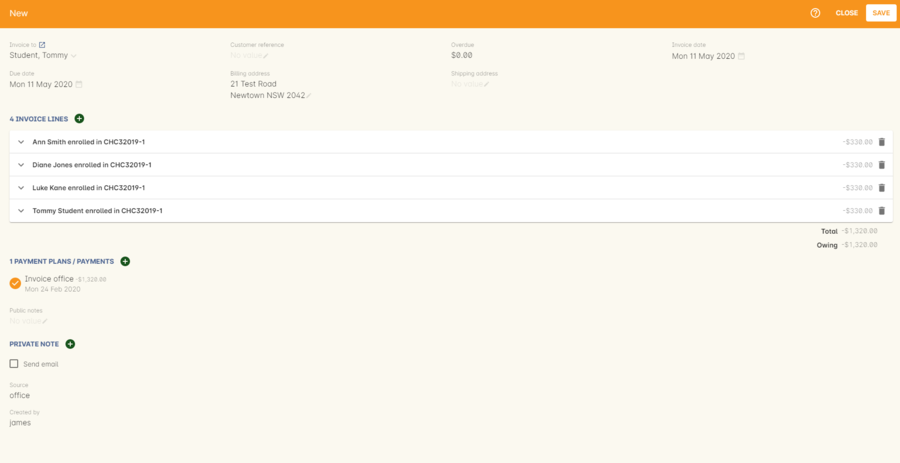

Using the Duplicate and Reverse function

The quickest way to create a credit note to fix an error is to find the original invoice, duplicate it and reverse it. Reversing an invoice manually allows you to make an adjustment (partial reversal) or complete reversal to an invoice created in error.

- Begin by opening the invoice window and locating the problem invoice.

- Single click on the invoice, and from the cogwheel select the option 'Duplicate and reverse invoice'. A new manual invoice/credit note window will open.

- This new credit note will contain all the same invoice lines as the original invoice line, but with each line item reversed. Remove any invoice lines you do not want to include in this credit note.

- To adjust the value of a remaining invoice line or charge the reversal to a different income account, click to expand it. You can make changes to any of the fields available in the box.

- Optionally link the reversal back to its original course-class code to deduct this amount from the class income. This will also make the invoice show in the class budget tab.

- Repeat the process for each additional invoice line you want to reverse.

- Remove the check box from the 'send email' option if you do not want a copy of this adjustment to be sent to the payer.

- Ensure the balance of the new invoice/credit note is as you expect before choosing save. You cannot edit the invoice/credit note after saving it.

Figure 252. Creating a credit note by duplicating and reversing the values of the original invoice

Updated almost 2 years ago